This is a difficult question, and one that is possibly more openly seen in the free markets of Germany and the United Kingdom than it is in the EPR controlled markets of the majority of the European nations.

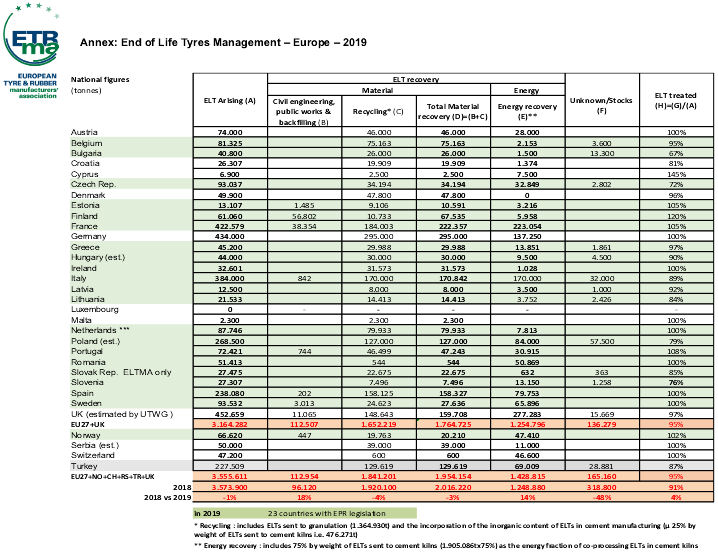

When we look at the figures produced by the ETRMA, they show, almost universally, high collection and recycling rates. Europe is, it appears, doing pretty well at recycling. However, all is not as it seems.

Starting with the easiest market for Tyre and Rubber Recycling to consider, the UK. Here, there have been consistently high collection rates of 80 per cent of arisings and above for many years. Certainly, most, if not all of the UK’s large tyre dumps have been removed and no new large scale dumps are arising. So, the UK seems to have a success story.

Except, the reality is that upwards of 200,000 tons of tyres get shipped out of the UK to India annually. A recent estimate puts the figure as high as 300,000 tons, almost 75 per cent of UK annual arisings are being shipped abroad, largely to India. These figures can be extrapolated from HMRC export figures, and also Indian import figures, confirmed by the volume of tyres and the market share claimed by Mumbai Fabrics, the largest importer of tyres into India.

This easy route to disposal is impacting upon the UK tyre recycling sector. It puts companies in the invidious position of having to take the cheapest route to recycle they can find – and it is cheaper to take the fees for a container of tyres than it is to process them into shred or crumb for markets that are somewhat restricted in the UK. One producer of sports surfaces told Tyre and Rubber Recycling that he could not find enough crumb in the whole of the UK to meet contract needs because the export trade had a cost-benefit that meant switching on a shredder, processing and selling product was not cost-effective.

Of course, the scenario has worsened since 24th February 2022, when energy prices started soaring due to sanctions on Russia.

Another recycler who had just invested heavily in shredding equipment told Tyre and Rubber Recycling that he could not afford to run the shredders, so the only option was to let tyres go for export to India.

This is the scenario that is developing in the UK, only those with the deepest of pockets and access to key markets can continue to process tyres. Investing with the inability to find domestic markets can have a poor outcome for the operators, as we saw with Twyford Recycling recently.

Even large-scale pyrolysis projects are having feedstock issues. The instability of supply is dissuading investors and holding back the development of projects that could be critical to developing the UK tyre (and plastics) recycling sector. We have seen that Wastefront has had to enter an agreement for its proposed Sunderland plant, with Gateway Resources for a wider feedstock supply – despite the UK exporting the majority of its arisings to India.

Germany has similar problems, compounded by their proximity to EPR management systems in France and Italy. When Tyre and Rubber Recycling last visited Germany, pre-covid, recyclers told us about struggling to find markets. They were exporting tyres if they could and where they could. Their previous market of cement kilns was diminishing, partly due to environmental concerns, but also due to the actions of neighbouring EPR agencies.

Aliapur, at one time showed on their website some 13 waste to energy outlets (cement kilns largely), of the thirteen outlets listed, most were not in France. Several were in Germany. This supply to German cement kilns undermined the market for German recyclers. The Germans had to pay the get fee that they could economically afford but the EPR agencies with their set collection fees could use their funds to undercut the domestic suppliers – they simply shifted their waste tyre issues across the border, and they became a burden to the German recycling sector.

This is an action that SDAB’s Fredrik Ardefors believes is wrong, and there he is hoping to manage Sweden’s arisings better through taking complete control of the ELT logistics chain. He does not believe that we should export, or that we should undermine each other’s domestic markets. Whilst confessing that exports do still happen from Sweden.

So, we already have a distorted image of the tyre recycling sector across Europe – the reality does not match up to the paperwork.

Ultimately, however, we look at things, be it from the UK, Germany, France, Spain or Italy, we are exporting our tyre waste – and this is without the complications of any ban on crumb rubber infill.

According to Genan and EuRIC, a ban on infill could add some 375,000 – 400,000 tons of tyres to the market, and the only place they have to go is India or some other export market.

If we continue to fail to find a use for recyclates in Europe; if we continue to export them as raw material to countries such as India, then we are creating a future where business cannot afford to recycle in Europe. We will have no recycling industry.

India is a growing economy, Indian businesses are investing globally. As ETRA’s Ettore Musacchi told Tyre and Rubber Recycling, the Indians own all the steel plants in Europe – we have sold them our industry. We cannot sell them our recycling sector or there will be no circular economy in tyres.

In the tyre sector, Indian reclaim, or devulc businesses are looking to export their devulcanised material back to Europe. We should not complain; they have reversed the colonial practices of the Imperial economies sucking resources out of the colonies, processing them and selling them back. The question is, does Europe really want to become a third-world player in recycling?

In Italy, there are estimates that the legitimate recovery and recycling may be as low as 50 per cent in some areas. The rest being managed by organised criminals. Waste is s good tool for covering drugs, gun running and even slavery. Waste in a black market just gets dumped, to the point that the area around Naples, home of the Camorra, is dubbed Terra dei Fuochi, “Land of Fires”, as the criminals burn their illicitly gathered waste

Giovanni Corbetta, the past Managaing Director of Ecopneus told Tyre and Rubber Recycling about the ongoing battle to educate the market in Italy through working with the Police, Fire Brigades and Local Authorities to combat waste tyre crime.

Back in the UK, there have been similar reports of organised crime using waste collection, even tyres, to cover other aspects of their criminality.

All of this does nothing to create an environment where businesses can invest in recycling. Why would anyone invest millions of Euros in a recycling plant to create a recyclate that has an unenthusiastic market, and which can be undermined at the drop of a hat by a man in a van, or a shipper with empty containers heading back to India?

Pyrolysis is the bright light on the horizon. Still, here the developers are beset with the same issues, feedstock, consistency of feedstock and the economics of competing against the quick turnaround and disposal through legitimate export, or illegal crime operations.

Across Europe, including the UK, governments need to be more proactive about developing waste management strategies. They need to mandate more recyclate use. They need to look at better ways of managing the outlets we have – don’t ban crumb rubber, look at how it can be better managed.

If they don’t, then perhaps the future of tyre recycling in Europe may be limited, whilst we hand the resources over to Indian and Asian businesses who will then sell us back the finished or part-finished goods.

But it doesn’t stop with India – India is not the bad guy in this story, India is building its business empire and there is no shame in that on their part. However, what India can do today, African states could do tomorrow.

This article has not even touched on the moral elements of shipping waste to countries with lower environmental controls. If Europe is serious about the environment, if it is serious about the circular economy, it has to create a greenhouse environment for the recycling sector to help it find its feet in a global market. Else, the future may not be as bright as we would wish.

All this is without even considering the reality of tyre recycling in the sustainability aims of the tyre manufacturers.