Gujarat based recycling machinery producer Fornnax Technology Pvt Ltd, bestowed with the prestigious ET Now ‘Best Brand 2024’ award

The recognition demonstrates company’s considerable contributions to the recycling industry, firmly establishing FORNNAX’s status as an industry leader.

Situated in the bustling industrial hub of Ahmedabad, Fornnax specialises in the production of top-tier recycling equipment tailored to the ever-evolving needs of the recycling sector.

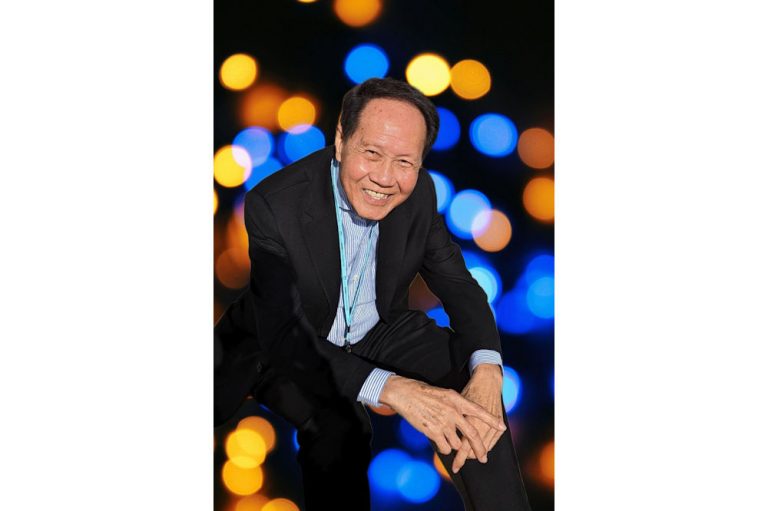

While accepting the award, Jignesh Kundaria, Director & CEO, Fornnax Technology emphasised, “We are dedicated to pioneering sustainable recycling solutions with our innovative offerings. Our mission goes beyond merely selling equipment; we are building a lasting business. This philosophy is at the core of who we are. This accolade inspires us to continue innovating and developing groundbreaking solutions for the recycling industry.”

The Economic Times presented this distinguished award to acknowledge and celebrate exceptional accomplishments within the recycling machinery manufacturing sector.

The selection process for the ‘Best Brand 2024’ award entailed a meticulous evaluation of several critical parameters, including brand value, market longevity of equipment, annual turnover, a remarkable 30 per cent growth rate, and strong brand recall among industry professionals and customers. These criteria reflect the extensive nature of the award and highlight the significance of Fornnax achievements.