Bridgestone EMEA, Grupo BB&G (BB&G) and Versalis (ENI) have announced the signing of an agreement aimed at establishing a closed-loop ecosystem to transform end-of-life tyres into new tyre

The agreement will bring together the innovation, experience and technological skills of all three companies. The partnership aims to develop a model for the creation of a scalable and increasingly sustainable supply chain.

Around one billion tyres reach the end of their useful service life every year, according to the World Business Council for Sustainable Development (WBCSD)’s Tire Industry Project. Bridgestone, BB&G and Versalis are seeking a solution that provides innovative and more environmentally responsible ways to address increased sustainability in the synthetic rubber business, helping to maximise the complete lifecycle of a tyre. The partnership between the three companies will contribute to achieving their environmental goals.

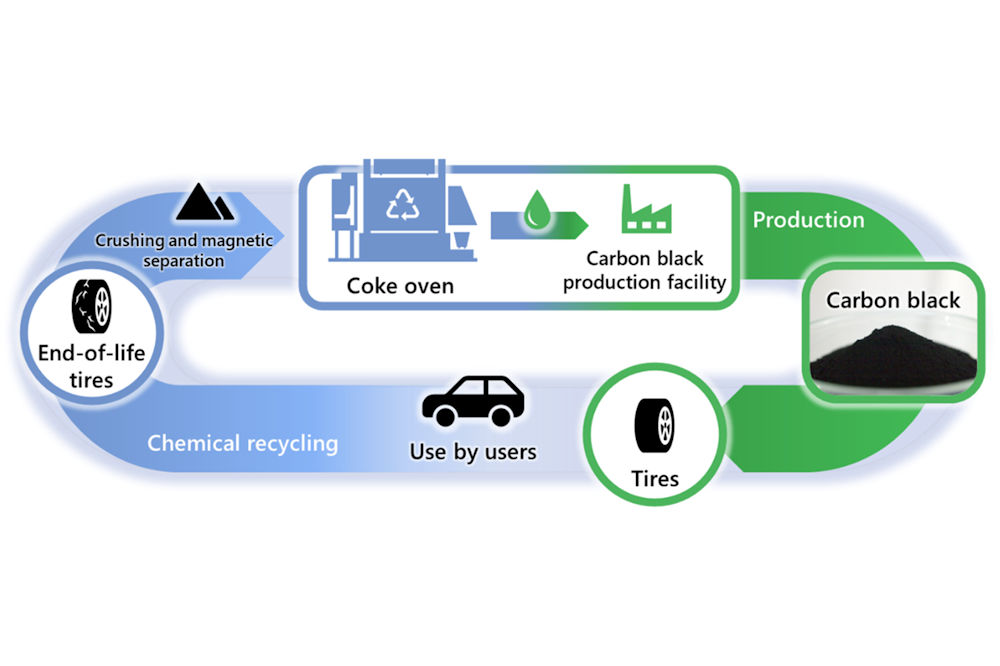

End-of-life tyres (ELTs) will be transformed, through pyrolysis, into tyre pyrolysis oil (TPO) to create high-quality elastomers comparable to those obtained from traditional feedstock for the production of new tyres. The three companies’ collaboration aims to boost the development of pyrolysis technology and TPO, as well as market scaling the polymers as a valuable circular resource for new tyres. The partnership will leverage BB&G’s thermomechanical process of pyrolysis to recycle end-of-life tyres on a commercial scale.

BB&G has built and operated two generations of pilot plants in the past 10 years and has also recently commissioned its first commercial scale tyre pyrolysis production to validate the feasibility and quality outputs of the process. BB&G’s TPO unit is located in Fatima, Portugal and has been successfully up and running since 15 July 2024. Over the next months, a first amount of BB&G oil will be fed into Versalis’ plants to manufacture the circular elastomers that Bridgestone will use to create a first batch of tyres in early 2025. The BB&G TPO commercial plant will help improve the circular tyre ecosystem and play a crucial role in facilitating global tyre circularity.

Versalis, ENI’s chemical company, has been developing circular technologies and processes through polymer recycling. This includes complementary mechanical and chemical recycling. The company is also engaged in the diversification of feedstock, with both renewable sources and secondary raw materials. Through this collaboration and based on its own technological expertise for recycled materials, Versalis will integrate BB&G’s pyrolysis oil into its own supply chain thus expanding the Balance® – ISCC PLUS certified – product range. Versalis’ elastomers are designed to ensure high performance. Bridgestone, a global leader in tyres and sustainable mobility solutions, can transform these elastomers into tyres with an enhanced percentage of rubber obtained from secondary raw material.

As part of the collaboration, all three companies will be working together to research and realise the best technical solutions to establish a successful ecosystem for future recycling of end-of-life tyres on a large scale.

Laurent Dartoux, Group President Bridgestone EMEA and Global Sustainability Initiative Lead Bridgestone Corporation, explains: “At Bridgestone, we have set a goal of working with 100 per cent sustainable materials by 2050, and recycling and reusing products is an important part of this. The partnership with industry leaders Grupo BB&G and Versalis to research, implement and overcome the challenge of recycling tyres will contribute towards this target. The collaboration also supports Bridgestone’s corporate E8 commitment, along with our global EVERTIRE initiative, which focuses on co-creating new and environmentally responsible ways to maximise the complete lifecycle of our tyres.”

Adriano Alfani, CEO of Versalis (ENI), commented: “In line with our strategy for circularity, we have developed lower-carbon solutions which perfectly fit in the value chain we’ve established with our industry partners Bridgestone EMEA and Grupo BB&G. This agreement aims at delivering maximum value to our customers and an innovative boost to the tyre industry, furthering our commitment towards a more sustainable mobility.

Germano Carreira, CEO of BB&G, concluded: “This strategic partnership with industry leaders Bridgestone and Versalis is a huge step towards achieving our visionary goal of accelerating tyre recycling worldwide. It confirms the value of our patented technology and acknowledges the persistence that has brought us to this crucial point, enabling us to expand our technology across different regions. This collaboration is not just about advancing our products; it is a joint effort to increase circularity in the industry, aligning with global sustainability goals.”

Some years ago, when approached about an Italian pyrolysis project, a representative from ENI is said to have told that particular project that they would only be interested in a commercialised process at 50,000tpa. This project looks like it may have the potential to exceed that capacity in due course.