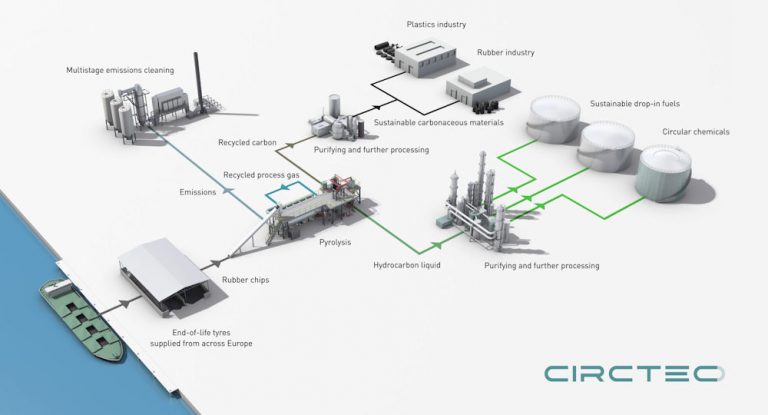

Circtec and bp have signed an eight-year offtake agreement for Circtec’s proprietary Hevea Upgraded Pyrolysis Advanced (HUPA) renewable drop-in marine fuel and circular naphtha petrochemical feedstock

bp has signed an eight-year offtake agreement with Circtec, a UK-based technology company that develops and operates innovative pyrolysis chemical process technology and whose plants convert hard-to-recycle waste tyres into HUPA – Circtec’s proprietary renewable drop-in marine fuel, and circular naphtha petrochemical feedstock.

Circtec is a company founded by Allen Timpany and Robert Harper in 2009. The company operates two commercial demonstration plants and is currently set to build a large scale plant in the Netherlands.

Under the agreement bp is committed to purchasing up to 60,000 tonnes per year of HUPA renewable drop-in marine fuel and up to 15,000 tonnes per year of circular naphtha petrochemical feedstock, on a take-or-pay basis, from Circtec’s new commercial-scale plant, for eight years after the new plant is commissioned. The €285 million new plant, currently awaiting construction in Delfzijl, The Netherlands, will be constructed to have the capacity to process 200,000 tonnes per year of waste tyres into HUPA renewable drop in marine fuel, circular naphtha petrochemical feedstock and circular chemical recovered carbon black (rCB). Construction of the new plant is planned to start this year with the first phase of the plant intended to become operational in 2025. BP has also committed to providing €12.5 million of investment through debt capital, to support the €100 million development of the first phase of the Delfzijl plant.

Over the past decade Circtec has invested in research and development, patent protection and extensive trials with multiple shipping operators to bring the HUPA product to the marine transport market. HUPA is 50% biogenic and its biogenic portion is certified as having a GHG reduction impact of 87 per cent compared to fossil marine fuel. The product, which is compliant with marine fuels regulations and standards – is ISCC certified for its Greenhouse Gas reduction effect and can be used by shipping operators, blended with fossil marine fuels, to meet the requirements of legal mandates on marine decarbonisation under the EU’s Fuel EU Maritime Regulation and Renewable Energy Directive.

Starting from next year, European Union legislation mandates a progressively increasing obligation on decarbonisation of marine transport rising to 80 per cent decarbonisation by 2050. This legislation is expected to drive demand for shipping companies sailing into and out of Europe to find lower carbon fuel products that are available at scale to fuel their vessels. Circtec is the only company globally that can make HUPA drop-in marine fuel from waste tyre feedstock that addresses these European mandates.

The Delfzijl plant is Circtec’s first large commercial-scale plant investment following a 15-year technology and product development process. Circtec is planning the development of several plant projects globally over the next few years, starting with North America and Southeast Asia, as direct owner operator plants and as joint-venture licensing partnerships.

A previous long-term offtake partnership for the entire output from the new Delfzijl plant of Circtec’s circular chemical product, recovered carbon black (rCB), was announced in 2021with Birla Carbon, one of the world’s largest producers of the chemical carbon black. This is supplied to Birla Carbon for their Continua SCM flagship decarbonisation product line. The processing capacity of the Circtec Delfzijl plant will account for circa 6 per cent of European waste tyres annually; over 50 per cent of European waste tyres are currently burned in cement plants or exported to Asia for disposal, according to the ETRMA. An ISO-standard Life Cycle Assessment of the Circtec plant investment shows it is expected to reduce GHG emissions by equivalent to circa 3 per cent of the national emissions of the Netherlands’ chemical industry sector once the plant is at full scale.

Allen Timpany, CEO and Cofounder of Circtec, said; “This entry into offtake and funding agreements with bp provides Circtec with a long-term offtake relationship, which will assist with our growth plans over the coming years, and accelerate the development of our pyrolysis plant capacity to produce renewable and circular products from waste feedstock. We hope that by working together Circtec and bp can help shipping operators tackle their GHG emissions, while addressing the serious environmental problem of end-of-life tyres. The Delfzijl plant will be a significant industrial decarbonisation investment in the Netherlands, and bp’s support is an important part of making that happen”.

Sven Boss-Walker, SVP Refining and Products Trading at bp, said: “We’re excited to work with the team at Circtec, especially as the company enters a new chapter and begins its expansion in The Netherlands this year. With the HUPA renewable drop-in marine fuel, Circtec is supporting the shipping industry with the solutions it needs to help achieve its sustainability goals.”